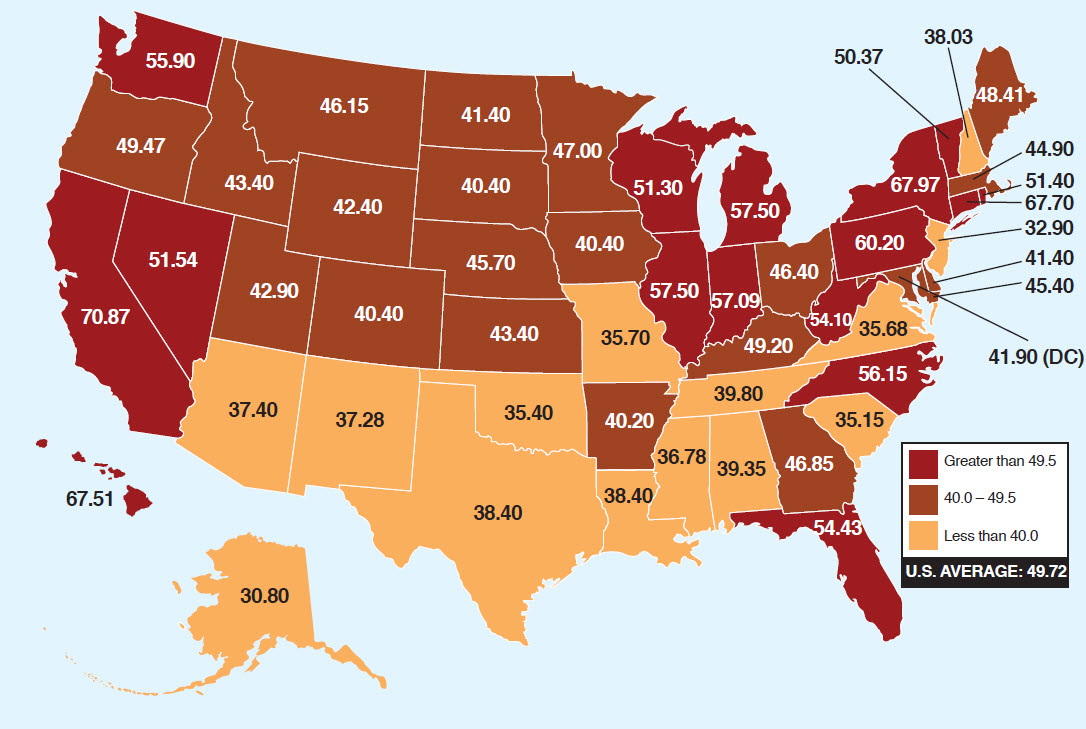

Have you ever wondered how much of the ~$3 per gallon that we pay to fill our tanks goes towards, federal and state fuel taxes, here it is, all laid out for you. The below numbers are the total tax per gallon by state. The US federal gas tax is currently 18.4 cents per gallon, so the rest is the state.

Click on the below map for an interactive version where you can drill down to the state to see how the state portion is derived.

As you can see above, the Live Free or Die State is a pretty good place to be, for the northeast.

You guys in Cali... sorry, but you win again.

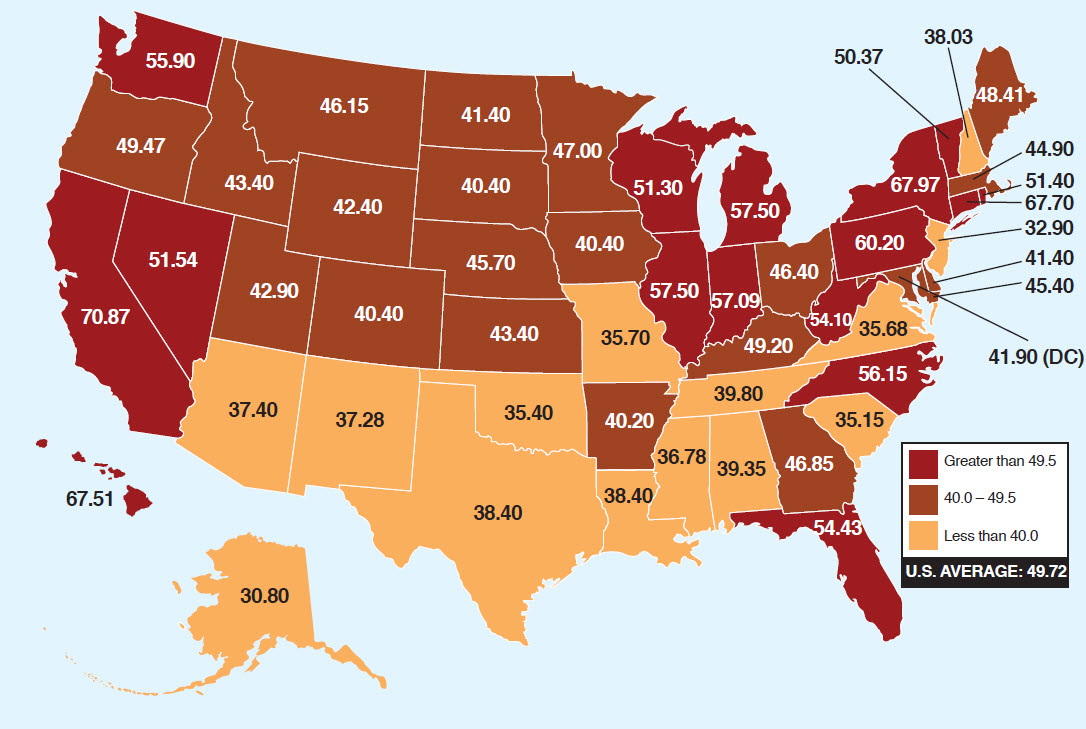

Click on the below map for an interactive version where you can drill down to the state to see how the state portion is derived.

As you can see above, the Live Free or Die State is a pretty good place to be, for the northeast.

You guys in Cali... sorry, but you win again.