Redfish Hunter

Gone Fishing

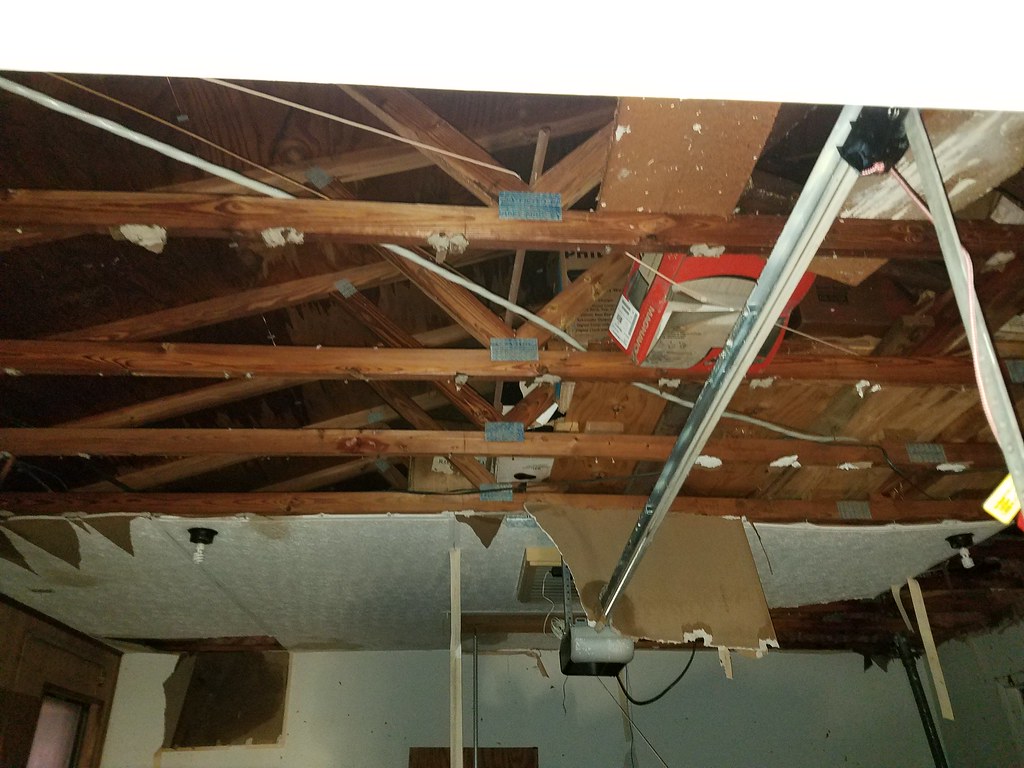

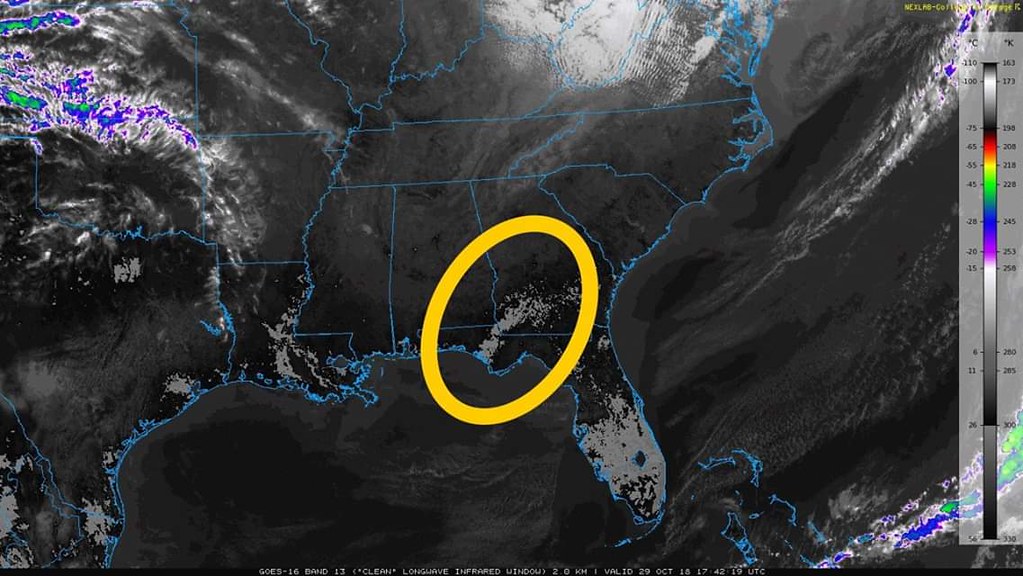

There is just no feeling in the world like having someone kick you in the face while you are already down. I have seen both ends of the insurance adjuster spectrum after a hurricane. Turned out there was a Hurricane Clause in many of the (especially Allstate) homeowner's policies in my area. There was an extra special deductible for a Hurricane. After Katrina and again after Gustav there were a lot of roofs that kept blue tarps in place for over a year following the storm. As you probably already know if a hurricane sends a storm surge and your house floods but you don't have flood insurance, you will be lucky to get anything.

Gustav destroyed my Castle on Wheels. I was instantly a Homeless Person. The adjuster that came was tired, grouchy, mean and very tired of dealing with liars and scammers. She hit me with a few sarcastic lines and dropped a few hints that sent me into a rage. The final straw was when I was explaining how we had used the neighbor/cousininlaw's John Deere to pull the oak limbs out of the roof.

I remember it like it was yesterday...

"And of course you paid him for that right?"

I told her, "Ma'am I am as low as a man can get right now. I don't have a house for my family to live in. As low as I am I still have too much pride to tell lies to someone I don't even know. No I didn't pay him. He helped me and then we went down the road helping everybody else. Nobody paid anybody."

She apologized and I later received a check for more than I had initially paid for the Castle on Wheels. They totaled it and the letter told me I could keep it or sell it but that our contract was terminated, they would no longer insure it.

Insurance is a business but adjusters are human beings. Some good, some bad, some make mistakes and some get it right.

Gustav destroyed my Castle on Wheels. I was instantly a Homeless Person. The adjuster that came was tired, grouchy, mean and very tired of dealing with liars and scammers. She hit me with a few sarcastic lines and dropped a few hints that sent me into a rage. The final straw was when I was explaining how we had used the neighbor/cousininlaw's John Deere to pull the oak limbs out of the roof.

I remember it like it was yesterday...

"And of course you paid him for that right?"

I told her, "Ma'am I am as low as a man can get right now. I don't have a house for my family to live in. As low as I am I still have too much pride to tell lies to someone I don't even know. No I didn't pay him. He helped me and then we went down the road helping everybody else. Nobody paid anybody."

She apologized and I later received a check for more than I had initially paid for the Castle on Wheels. They totaled it and the letter told me I could keep it or sell it but that our contract was terminated, they would no longer insure it.

Insurance is a business but adjusters are human beings. Some good, some bad, some make mistakes and some get it right.